See how you can get the information you need to give your customers hyper-personalized omnichannel communications through third-party data sources and modern data analytics techniques.

More personalized interactions only make business better and customers happier. Deliver experiences that cater to each customer and increase interest, loyalty and sales along the way.

Top brands trust Taylor to deliver true omnichannel experiences using deeper

customer insight and industry specific strategies. You can, too.

Use customer life stages, buying behaviors and preferences to make it easy

for customers to interact with you where and when they prefer, and even to

anticipate their future needs.

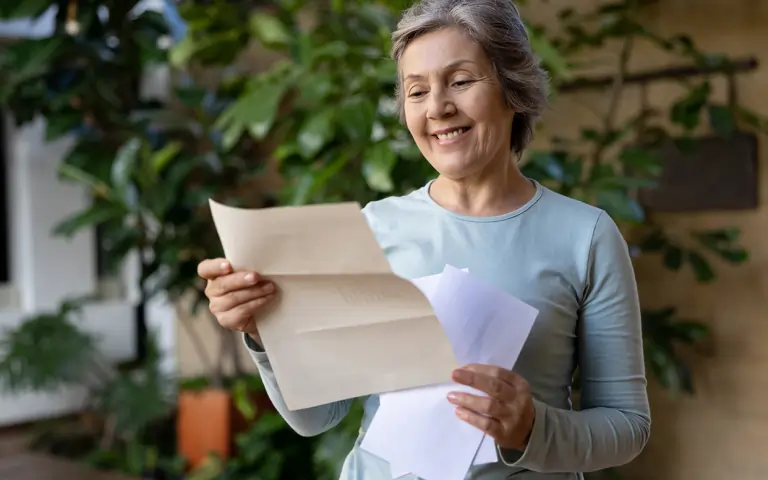

Despite what you may have heard, print is not dead. Direct mail is valuable because it allows you to reach customers offline in a personalized and targeted way. It’s a great way to start the conversation and get people on board.

Even though it seems like we receive more than we can possibly open, email is still a powerful tool. In addition to being easily personalized, they are a great asset when it comes to data and tracking analytics.

Display ads work wonders on websites, social media platforms and mobile apps. You can target potential customers based on their interests and browsing behavior. Sometimes they only consist of a few words, but their impact can be huge.

Whether it’s Facebook, Twitter, Instagram, LinkedIn or another platform, integrating social media into your campaigns gives you the chance to connect with your customers on a 1:1 level.

Reaching customers at the right place and time isn’t based on luck. There are ways to learn how they

behave, where they browse and buy, and what motivates them to seek your services.

Deeper knowledge of your target audience lets you deliver a more personalized experience

Deeper knowledge of your target audience lets you deliver a more personalized experience.

Organize your current and prospective customers into specific groups based on their preferences, buying behaviors and shared characteristics.

Real-time access lets you direct and follow your campaigns while they’re in progress.

Your guide to determining where customers are in the buyer lifecycle and exactly what information you need to send them.

Collect and evaluate demographics, psychographics, household buying behaviors, life-stage triggers, geography and more.

Want the full customer picture? Get data segments that let you deliver omnichannel

communications at every stage of the customer journey.

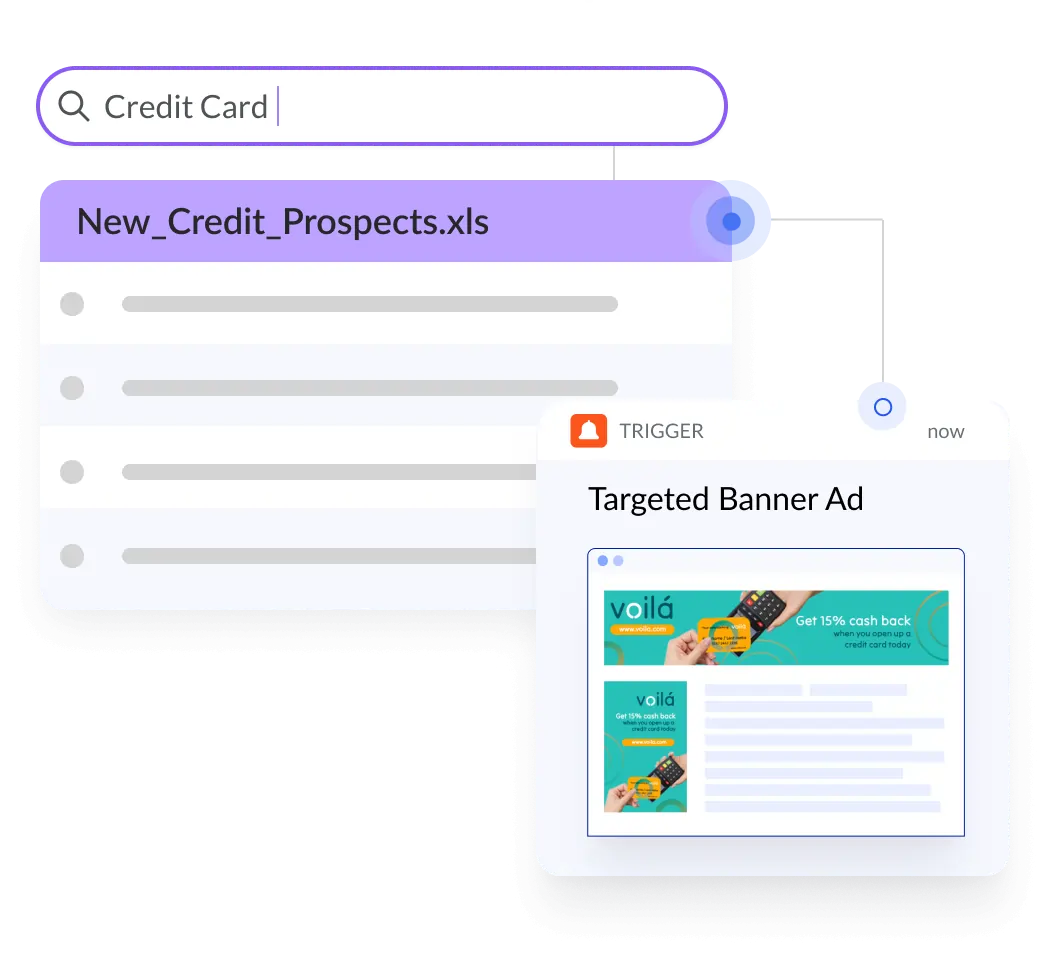

Most of the time, the only way you know if an interested consumer has been to your website is if they take action . . . open an account, set up a meeting, etc.

Feel like doubling your chances of gaining a customer? Our data analysis tools collect information from multiple channels that can help you find out which consumers are searching for your products and services online - and which ones are looking at your competitors.

Reach and convert consumers actively seeking your products and services online.

Based on data assessments that identify customer attributes, we’ll recommend audience strategies to target your most promising customers.

Customer profiles will be used to build personalized omnichannel messaging aimed at driving these newly acquired customers to your store or website.

Get more granular than ever before with mobile behavioral triggers, mobile location triggers and life-event data your marketing teams can use to reach customers at precisely the right time.

We’re one of the financial industry’s leading providers of in-market purchase intent data and analytics. Our data platforms connect more than 400 million mobile devices that link online and offline data.

What if you could predict what your customers might be interested in next? With buyer journey mapping, you can.

Through a data assessment and purchase behavior analysis, we will create an AI-driven predictor model that can identify what customers will likely purchase next. Once they are identified, we develop an omnichannel campaign to reach these return customers in the channels they prefer.

Acquiring new customers isn’t the only way to grow your revenue. It is possible to reengage lapsed customers and bring them back on board.

Based on your current customer profiles, we’ll be able to create a custom AI model that identifies the customers that have the best chance of reactivating, and develop personalized omnichannel communications to reach them.

It’s time to throw out your spreadsheets. Taylor’s in-branch marketing management system, makes streamlining your location-specific marketing easier than ever before.

Map and manage all your branch-specific media for every location with one platform.

Track and measure the performance of all your communication

channels through a single platform.

Integration is easy. Our installation experts pair the dashboard with

your existing technology to collect and report the data you need.

Credit unions of all sizes have grown their customer base using the data-driven omnichannel solutions delivered by Taylor experts and consultants.

Your source for success stories, design and engineering tips, and all things financial marketing.

See how you can get the information you need to give your customers hyper-personalized omnichannel communications through third-party data sources and modern data analytics techniques.

A regional bank wrote 700 new mortgage loans and saw a 30% increase in new accounts after using new data analytics techniques led to engagement with more than 3,000 new customers.

Learn how making data-driven decisions can help you expand your membership by using customer data you already have on hand.

We do way more than financial marketing. We help organizations reach more

customers in every industry.

Expand your brand’s visibility and impact by giving customers seamless marketing experiences

Retail experiences are enhanced by signage that connects your in-store and online campaigns.

Fields marked with an asterisk (*) are required.