Material Matters from Taylor - Q4 2025

We want to keep our partners in the loop regarding the latest sourcing trends, market developments and the overall state of supply chains today.

That’s why we created Material Matters.

Sourcing and Supply Chain Updates

Read on to get the latest news for the paper, label, packaging, promotional, logistics,

import markets (including tariffs), regulatory and compliance updates, and color management.

Table of Contents

Market Overview

Q4 2025 Market Trends and Economic Indicators

Institute of Supply Chain Management (ISM) manufacturing PMI index finished at 49.1%for September 2025 indicating contraction in manufacturing.

That said, September PMI index is a slight increase from August 2025 and a 2% increase from September 2024. New orders, backlogs, production and raw materials inventories all contracted at varying rates while overall prices continue to remain higher. Index still points to growth in the U.S. economy (GDP increased to 3.8% for 2nd Qtr 2025) despite manufacturing contracting.

Consumer Spending/Sentiment

Consumer sentiment continued to decline for second month in a row. The University of Michigan's Index of Consumer Sentiment declined to 55.1 in September, a 3.1 decrease from previous month. Primary drivers include: higher prices; pessimism about labor market and the softening of personal income.

Commodity Pricing

Commodity pricing is mixed among heavy metals, chemicals, plastics, packaging and energy components with aluminum, copper, corrugated packaging, paper products and electronic components seeing higher rates of increasing prices. The U.S. tariff policy remains a focus for manufacturers, and ultimately for consumers. (See Imports section for more details.)

Energy

WTI crude oil, U.S. diesel fuel and standard gasoline are all expected to continue to be lower and/or flat for the remainder of 2025 as well as into early 2026. This is primarily driven by lower WTI oil prices due to lower demand and higher production and inventories. Natural gas pricing is expected to increase due to higher global demand.

Inflation & Interest Rates

forecast sentiment is based upon tariff impact on consumer prices.

Paper Market Overview

Tariffs are impacting paper imports in varying degrees as some mills are negotiating tariff rates with customers. Importers will be forced to pass through some of the cost of tariffs. The U.S. needs imported paper as the country does not have the capacity to meet current demand.

However, while tariffs continue to send mixed signals, the broader economy remains resilient.

The paper industry is forecasting slight increases in mill operating rates for the remainder of 2025, driven by seasonal demand, tariff impacts and reduced supply.

Fastmarkets projects price increases by year-end and into 2026. Several CFS (coated free sheet) producers, including Billerud, Sappi, Lecta, Hansol, Hankuk and Moorim, have announced price hikes on coated sheets and web grades.

Printing & Writing Papers

In July, shipments of printing and writing papers declined by 8% compared to July 2024, according to the AF&PA. In contrast, packaging papers and specialty packaging saw a 5% increase over the same period. Major producers like Billerud and Sappi continue to pivot toward packaging grades. Billerud has announced plans to reduce its graphic paper capacity from 800K tons to 600K tons by 2030, signaling a long-term strategic shift.

Mill Shutdowns & Conversions

August saw an acceleration in mill closures and conversions. These closures represent “the largest downward capacity adjustment ever" according to Fastmarkets.

International Paper (IP)

International Paper (IP) sold its pulp business and converted 260K tons of white cut stock into 430K tons of containerboard. It also shut down two container board mills totaling 1.4M tons of capacity.

Pixelle & Domtar

Pixelle completed the shutdown of its Chillicothe mill on August 10, while Domtar closed 235K tons of newsprint capacity, representing 10% of North America's total.

Other Closures

More notable closures in 2025 include UPM, Willamette Falls, Irving Paper, Greif and Cascades.

Envelope Industry & Technology News

Elutia Bioevenlope Sale to Boston Scientific

October 1, 2025, Elutia announced the successful closing of an $88 million sale of its bioenvelope technologies to Boston Scientific, focusing on the advancement of drug-eluting biologics for medical devices.

Pidgeon Envelope Facing Foreclosure

Major Ohio-based envelope manufacturer, Pidgeon Envelope LLC (parent of Envelope 1 LLC) is facing court-ordered foreclosure and sheriff's sale due to outstanding debt payments.

Innovations in Interactive Envelopes

Envelope manufacturers are incorporating augmented reality and near-field communication RFID NFC technology into envelopes, transforming them into interactive marketing tools that offer digital content and memorable brand experiences.

North American Coated Freesheet Operating Rates

North American Uncoated Coated Freesheet Capacity and Demand

Label Market Overview

Q3 2025 saw some price increases and tariff surcharges on raw materials, though not uniformly across all label suppliers. Q4 2025 pricing is expected to remain fairly stable, but some key label material suppliers have hinted at potential pricing changes in early 2026 as they continue to monitor global tariff impacts on their business.

Supply of general label materials is stable, as demand continues to be much slower than expected during second half of 2025.

Paper Facestocks and Liners

- Thermal paper and paper liner material supply and demand remains balanced with continued emphasis on CA Prop 65 and WA Phenol-Free product requirements.

- Global supply and lead times on standard products are expected to remain stable with longer lead times for specialty paper-based label materials.

- Platinum prices continue to soar, hitting an all-time 12.5 year high, surpassing $1,600/ounce. Driven by a strong rally since April 2025, platinum significantly outperformed gold and silver, which is expected to have some effect on silicone liner manufacturing costs in Q4 2025/early 2026.

Films and Adhesives

- BOPP film prices may see some slight increase in market pricing during Q4 2025/early 2026, primarily driven by expected increases in ecommerce and food packaging demand during holiday season.

- Acrylic and hot-melt adhesives demand and supply is expected to remain stable into Q4. Raw material input costs for adhesives seems to be holding steady both domestically and internationally.

- One major international BOPP film supplier, Jindal (India) will close its U.S. manufacturing facility in November 2025. There should be minimal impact to raw material supply. PET film prices are expected to remain stable going into Q4 2025.

Labels PPI

The graph below details the Producer Price Index (PPI) for raw label pressure-sensitive materials from August 2023 through August 2025.

Packaging Market Overview

The overall packaging market continues to show some instability due to tariffs,

paper mill closures, consolidation and overall North American demand.

Aluminum & Tooling/Die Categories

- Aluminum material pricing is expected to remain stable through Q4 2025, but tariffs are significantly impacting CTP equipment, with aluminum raw materials continuing to be the most affected.

- Tooling and die markets have implemented price increases and/or tariff surcharges, driven by both material costs and trade policy shifts.

Corrugated and General Packaging Supplies Update

- Pricing is expected to remain flat the remainder of the 2025.

- The corrugate market is projected to continue growing through the end of 2025, fueled by e-commerce and food packaging demand.

- Tariff concerns persist, especially due to the active trade of roll stocks between the U.S. and Canada.

Wood Pricing

- Used pallet pricing should remain stable through the remainder of the year. Raw materials for used pallet production remains in abundance throughout the U.S. This is caused by a slower new housing market, resulting in a surplus of new lumber.

- Tariff changes between the U.S. and Canada are a concern since lumber utilized in the Midwest is primarily imported from Canada.

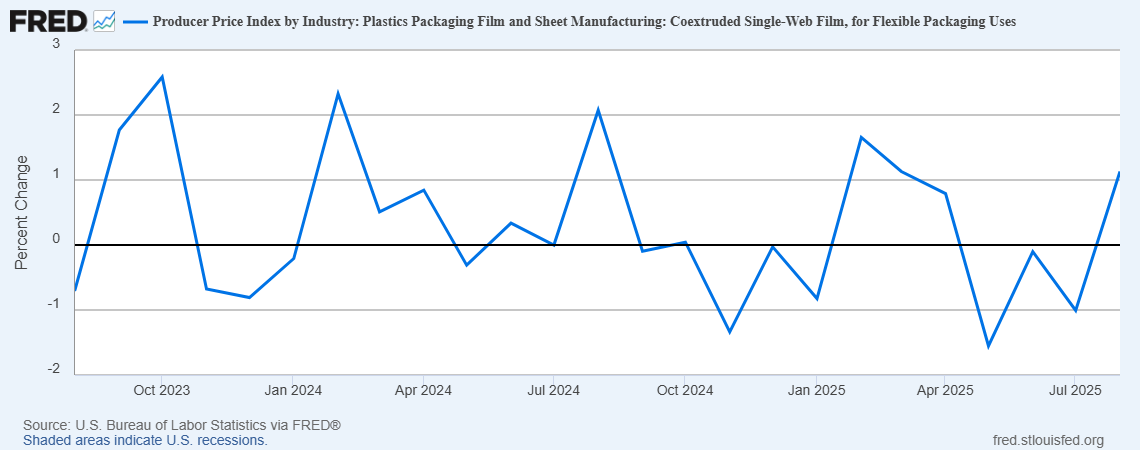

PPI: Flexible Packaging Film

The graph below details the Producer Price Index (PPI) pricing for flexible packaging film from August 2023 through August 2025.

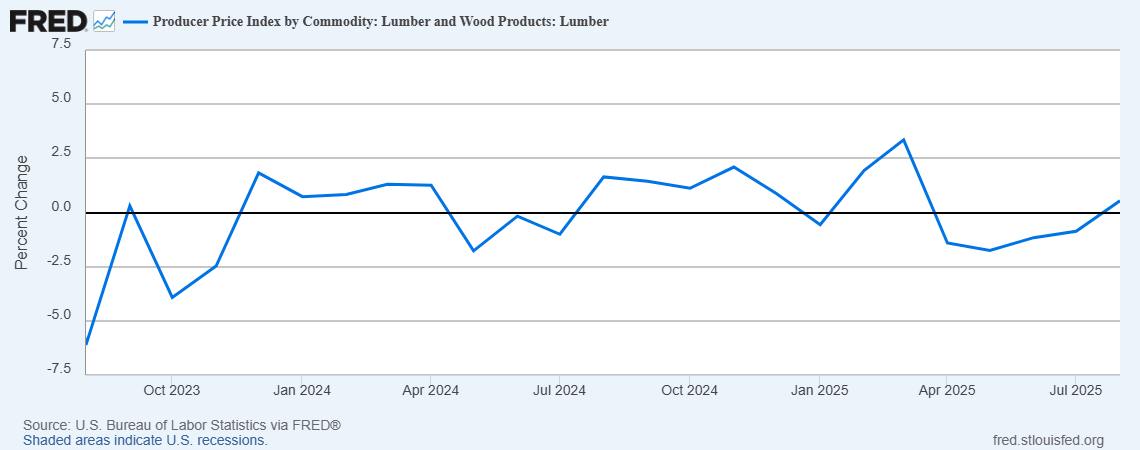

PPI: Lumber and Wood Products

The graph below details the Producer Price Index (PPI) pricing for lumber from August 2023 through August 2025.

Promotional Market Overview

Reciprocal tariffs implemented in July and August now affect most countries and promotional product categories.

The Supreme Court is set to review the legality of the current tariff structure following President Trump's request.

Promotional Product Momentum

What are the best promotional trends of 2025? EverythingBranded has your answer.

Logistics Market Overview

The logistics industry enters Q4 2025 amid persistent volatility driven by tariff

reviews, holiday season demand and regional disruptions. While U.S.-bound flows from

Southeast Asia remain strong, Golden Week slowdowns in Asia and regulatory shifts

in India are impacting global freight patterns.

Inland networks are sensitive to capacity constraints and customs readiness,

requiring proactive planning for holiday arrivals.

Small Package Market Overview

The small parcel shipping market faces a complex landscape of ample capacity and soft demand, with carriers employing aggressive strategies to offset volume challenges through pricing mechanisms.

Carrier Capacity

Major carriers (UPS, FedEx, DHL, USPS) maintain stable capacity, but last-mile congestion and urban delivery bottlenecks are emerging as peak season ramps up. Infrastructure investments continue to support volume surges, though cross-border shipments face compliance challenges.

Pricing Strategies

Q4 2025 sees continued rate pressure with USPS, FedEx and UPS implementing general rate increases (5.9%) and peak season surcharges. Dimensional weight pricing and residential delivery fees are up over 25%, prompting shippers to reassess packaging and carrier mix.

Outlook

Shippers must stay agile, leveraging technology, blended carrier strategies and service level audits to manage rising costs and maintain delivery performance. The Taylor team will continue to align with optimal logistics partners to support business needs through the holiday surge and into 2026.

Less-Than-Truckload Logistics Market Overview

The North American LTL market enters Q4 2025 in a rebalancing phase, following the closure of Yellow Corporation and ongoing carrier consolidation.While freight volumes remain below pre-pandemic levels, signs of recovery are emerging, driven by industrial manufacturing, nonresidentialconstruction, and cross-border trade with Mexico. Infrastructure investments and regulatory changes are reshaping inland networks and customsprocesses, requiring shippers to stay proactive.

Carrier Capacity

Capacity remains tight due to reduced competition and redistributed freight from Yellow’s exit. Major carriers like FedEx Freight and XPO are expanding service areas and investing in automation, but regional bottlenecks and longer transit times persist in some lanes.

Pricing Strategies

Rates are increasing steadily, with Q4 seeing higher surcharges for expedited and specialized services. Fuel costs remain elevated, and AI-driven freight management systems are being adopted to optimize pricing and routing.

Outlook

Shippers must prepare for continued rate pressure, tight capacity and longer lead times. Strategic carrier selection, technology adoption and flexible routing will be key to maintaining service levels. The Taylor sourcing team will continue to align with reliable LTL partners to support business needs through Q4 2025 and into 2026.

Truckload Logistics Market Overview

The North American truckload market enters Q4 2025 in a transitional phase,

marked by moderate freight demand, seasonal volatility, and tariff-driven cost

pressures. While the broader economy shows signs of softening, freight volumes

remain stable in key sectors like construction and agriculture. Regulatory

developments, including EPA 2027 emissions standards and tariff reviews, are

adding complexity to long-term planning.

Capacity & Demand

- Capacity remains balanced to slightly tight in high-demand lanes, especially in the Southeast and Midwest. Reefer demand is shifting post-harvest, while flatbed volumes are supported by ongoing infrastructure projects.

- Dry van volumes are steady but show regional variation due to weather and retail cycles.

Rates & Pricing

- Spot rates are stable to slightly elevated, with seasonal increases expected through the holiday period. Contract rates remain competitive, but carriers are selectively increasing rates in constrained lanes.

- Fuel surcharges and accessorial fees are trending upward due to inflation and regulatory compliance costs.

Outlook

- Shippers must prepare for peak season disruptions, including

weather-related delays and reduced carrier availability around holidays. - Strategic planning, flexible routing, and early booking are essential. The Taylor team will continue to leverage strong carrier relationships and

data-driven insights to ensure reliable service and cost control.

International Logistics Market Overview

Global logistics in Q4 2025 is shaped by geopolitical disruptions, trade realignments

and modal shifts. The Red Sea crisis continues to reroute ocean freight via the Cape

of Good Hope, increasing transit times and costs. Meanwhile, the China+1 strategy

has accelerated sourcing diversification, boosting trade flows through Vietnam, India

and Mexico. Port congestion remains elevated in trans-shipment hubs like Jebel Ali

and Salalah, while air cargo sees a resurgence due to time-sensitive demand and

ocean delays.

Ocean Freight

Rates remain volatile due to rerouting and insurance surcharges. Drewry’s World Container Index dropped 6% in late Q3, but Shanghai–Rotterdam rates fell 10%, reflecting overcapacity and shifting demand. Port expansions in Egypt and Greater China aim to absorb redirected flows.

Market Sentiment

Volumes rose 7%–10% YoY, driven by electronics, pharma and fashion. Middle East hubs like Dubai and Doha gained prominence, while AI-driven forecasting tools are helping carriers manage capacity and optimize routes.

Technology & Infrastructure

Warehouse automation and logistics tech adoption surged, with robotics, digital twins and AI-based pricing platforms becoming mainstream. These tools are critical for navigating rate volatility and improving freight visibility.

Outlook

Shippers must prepare for longer lead times, higher costs and regional bottlenecks. Strategic sourcing, modal flexibility and tech-enabled logistics will be essential. The Taylor team will continue leveraging global partnerships and digital tools to support international freight needs throughQ4 2025 and into 2026.

Van Demand & Capacity

Van Load-to-Truck Ratio

U.S. Postal Service Market Updates

Network Modernization

- USPS launched 10 new Sorting and Delivery Centers (S&DC's) in September 2025 and one more in October 2025, consolidating delivery units to simplify the network and improve reliability and efficiency.

- "Delivering for America" Plan: These S&DC's are a key component of the broader plan to create a world-class processing and delivery network.

Pricing & Affordability

- No January 2026 Price Increase: Postmaster General David Steiner announced that there will be no increase in prices for market-dominant products (including First-Class Mail and stamps) in January 2026, a decision aimed at balancing revenue needs with affordable offerings.

- Focus on Efficiency:

The strategy to maintain service reliability and productivity aims to avoid price changes for now.

Wages & Compensation

- COLA Adjustment:

Career Mail Handler craft employees received a Cost-of-Living Adjustment (COLA) of $790, effective September 6, 2025.

New USPS 2025 and 2026 Promotions

- Registration for catalog insights was effective as of Aug. 15, 2025. Tactile, sensory and interactive promotion registration started Oct. 15, 2025.

- All the New 2026 Promotions: 2026 Promotions Guidebooks | PostalPro

International (Imports) Market Overview

The next two months will be focused on legal challenges to the collection of IEEPA tariffs and the increase of sectoral tariffs on specific industries.

More trade deals will be signed - including the renegotiation of the USMCA and challenges implementing current trade deals.

Supreme Court Agrees to Review IEEPA Tariffs

The U.S. Supreme Court agreed to review whether the International Emergency Economic Powers Act authorizes

the president to impose tariffs via executive order. The case will be heard on an expedited schedule, most likely during the first week of November (3, 4 or 5).

If Supreme Court upholds the President's tariffs, that is the end of the judicial challenges to tariffs and there would be no refunds.

%20Market%20Overview/International-Market-Overview.webp)

Next Steps

If the Supreme Court affirms the illegality of the tariffs, the specific written results will be used to determine whether tariff collection will cease and if there will be a refund mechanism for the collected tariffs.

For Importers

It is critical for importers affected by any of the IEEPA tariffs to monitor the liquidation of entries on which such tariffs were paid so that protests may be timely filed.

More Information

The ruling will not affect Section 232 of the Trade Expansion Act of 1962 (steel and aluminum.

It will also not affect other Section 232 investigations that could lead to future tariffs on semi-conductors, pharmaceuticals, timber, lumber and other products.

Tariff Notes and Exemptions

Reciprocal Tariffs

Tariff rate deemed necessary to balance bilateral trade deficits

between the U.S. and each of our trading partners.

| Regions | Tariff Category | Current % | End Date | Notes | What Could Happen |

|---|---|---|---|---|---|

| China | Reciprocal tariff | 10% - 30% Average: 10% |

November 10, 2025 | On August 11, the current administration extended the reciprocal tariff for another 90 days. In the meantime, China and the United States will continue negotiations. If there is still no new agreement, tariffs will increase to 34%. All products apply. |

Currently, the baseline reciprocal tariff rate is 10% for all countries except those listed in link below. |

| All nations except China, Canada and Mexico | Reciprocal list of country-specific tariffs | 10% | Continuous |

As of August 7, 10% minimum for all countries, then specific rates at 10%-49% for all non-exempted goods for 95 countries. |

Currently, the baseline reciprocal tariff rate is 10% for all countries except those listed in link below. |

Tariffs Using Section 232 and Section 301

Impact on Specific Industries and Products

Section 232 of the Trade Expansion Act of 1962 allows the Secretary of Commerce to

investigate whether imports threaten U.S. national security. Section 301 of the Trade Act of

1974 authorizes the USTR to address unfair foreign trade practices that harm U.S. commerce.

The administration has multiple investigations on whether imports of such items threaten to

impair national security. On the list are imports such as trucks, robotics, pharmaceuticals, medical

equipment and PPE (personal protective equipment) including some devices, and medical consumables.

| Products | Tariff Category | Current % | Effective Date | Updates |

|---|---|---|---|---|

| Copper and copper derivatives | Section 232 | 50% | August 1 | The tariff rate of 50% is applicable to only the metal content. Other tariffs apply to non-metal content. |

| Forestry products | Section 232 | Varies - see updates | September 29 |

|

Tariff Mitigating Strategies

Diversifying Country of Origin

Sourcing from other countries least impacted by tariffs.

Tariff Engineering

Designing the product to fit into the appropriate product classification based on HTS (Harmonized Tariff Schedule).

Understanding Free Trade Agreements

Including regional value content rules as well as rules of origin.

Use of Foreign Trade Zones

When possible.

Valuation Management

Using First Sale to qualify for use of manufacturer cost as the dutiable value.

Engage with Trade Professionals

Such as customs brokers, customs law practitioners and trade consultants.

%20Market%20Overview/Tariff-Mitigating-Strategies.webp)

Compliance/Regulatory

Market Overview

The U.S. and global regulatory landscape continues to evolve at a rapid pace. According to data from one

of Taylor’s affiliated testing laboratories, approximately 4,500 new regulations have been proposed or

enacted as of the end of Q3 2025 — a record-setting figure with three months still remaining in the year.

This is an increase of roughly 1,500 regulations compared to the volume seen three to four years ago.

Assessing New Regulations

Taylor Enhancing Efficiency For You

Taylor Compliance Bot

Taylor continues to focus our attention on being more efficient in providing current raw materials and finished products global regulatory and compliance supporting information for our internal and external stakeholders. Our newly developed AI-driven compliance bot allows for self-service access to this important information as part of our value to Taylor customers.

Monday.com

Taylor utilizes the Monday.com platform for tracking and monitoring inbound raw material and finished goods compliance requests. Monday.com is a cloud-based application that provides real-time metrics and visibility for each request. This application also helps identify significant regulatory challenges, supplier response performance, and overall trends based upon inbound compliance requests.