The latest statistics on check fraud are in and the numbers are staggering. According to the Bank Administration Institute, check fraud increased more than 100% in 2022 while the volume of checks written increased only 8%. Things are expected to worsen in 2023. Industry experts now predict that check fraud schemes will result in $24 billion in losses at U.S. banks this year.

Fraudsters have been using checks to steal other people’s money ever since checking products were introduced in the 18th century. Thanks in part to color photocopiers, scanners and high-quality digital printers, fraud techniques have become more sophisticated in recent years. However, the attempts still generally revolve around three broad forms of check fraud:

- Writing a check against one’s own account when there are insufficient funds available.

- Forging or altering someone else’s otherwise valid check document.

- Creating or counterfeiting an entirely fake check document.

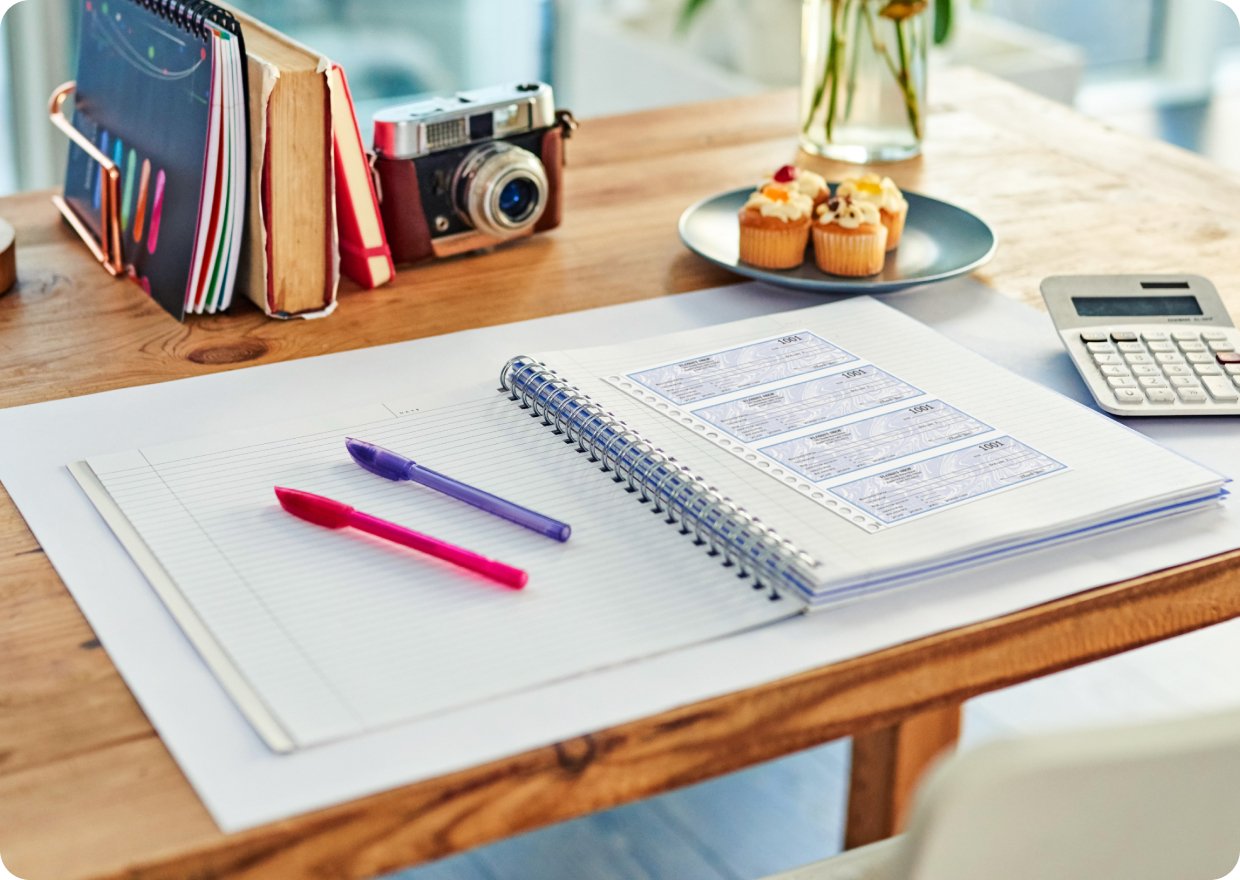

.jpg?width=1455&height=626&name=Blog%20Body%20Image%20%E2%80%93%20Check%20Security%20+%20Fraud%20Prevention%20(2).jpg)

Thankfully, security features are available that enable consumers and financial institutions to recognize a fraudulent check before the damage has been done. This blog will look at the various security features used to prevent the forging, altering and counterfeiting of checks.

Check Fraud Security Features

.jpg?width=1455&height=626&name=Blog%20Body%20Image%20%E2%80%93%20Check%20Security%20+%20Fraud%20Prevention%20(1).jpg)

Abrasion Ink

Also known as abrasive ink, this is a white transparent ink that appears gray when rubbed with a coin. Some abrasion inks fluoresce when placed under a black light.

Strengths

- Abrasion ink cannot be photocopied and provides some protection against photocopying, scanning and counterfeiting.

- The abrasion ink is colorless and hidden upon casual inspection.

Liabilities

- Certain smooth and coated papers can cause the hidden abrasion ink to become visible.

Artificial Watermark

Symbols can be printed on the document in white or transparent ink that become visible to the human eye when viewed at a 45° angle. The symbols can also be designed to fluoresce under a black light. These features are also known as simulated watermarks.

Strengths

- Artificial watermarks are difficult to replicate, providing moderate protection against copying and counterfeiting.

Liabilities

- The imprinted image can be difficult to see, reducing its effectiveness at the point of acceptance.

Chemical Pen

A specially designed pen can be used to unveil an invisible mark or message, making a check authentication easier.

Strengths

- Chemical pens can be used to activate tamper-evident void features.

Liabilities

- The pens themselves are not always convenient to use. They tend to dry out and are often flammable or emit strong odors.

Custom Screen Halftone

Used instead of the dots of a conventional halftone screen, a screened image is made from simple letters or shapes and applied to continuous-tone images or photo art.

Strengths

- A user can authenticate the document by viewing it under magnification of 8x or more, resulting in the screened image to appear.

Liabilities

- Authentication is difficult without the aid of magnification.

Defaced Voucher

A relatively simple modification to most check designs, a defaced voucher adds background printing (sometimes a logo or seal) to the blank areas of the document.

Strengths

- Pre-printing the phrase “non-negotiable” (or something similar) makes it more difficult for a fraudster to use the paper for counterfeiting.

Liabilities

- The background pattern can create some visual “noise” against printed text.

Dual-Image Numbering

Dual-image numbers use ink that contains two different components: black and red. The black component is visible on the front and is surrounded by a red halo. The red component penetrates the paper fibers into the document and is usually visible on the back of the sheet. Sometimes known as dual-component numbering or red penetrating numbers.

Strengths

- Penetrating inks offer a limited degree of protection against color copying and counterfeiting. In addition, the red halo will bleed substantially – or even disappear – during attempts at check washing.

Liabilities

- A high-quality two-sided color photocopy can often pass as an original.

Embossing

A matched set of dies is used to distort the paper, resulting in a raised surface on one side of the document and a depressed surface on the other.

Strengths

- Embossing cannot be easily copied or counterfeited, offering a moderate level of security against fraud.

- The 3D image can be sensed by touch and the detail is difficult to reproduce.

Liabilities

- Embossing often does not work well on paper that will be run through sheet feeders, laser printers and copiers.

Fibers

Colored and fluorescent fibers can be embedded in the paper stock itself as it is manufactured, becoming part of the base sheet. The fluorescent fibers glow when exposed to ultraviolet light.

Strengths

- The inclusion of colored fibers and fluorescent fibers provides moderate protection against copying and counterfeiting.

Liabilities

- It is possible to emulate the appearance of the fibers with a color printer.

- The fibers must be carefully examined to ensure authentication, requiring the use of a black light.

Fluorescent Inks

Fluorescent inks are used in images or words printed on the document that are difficult to see by the human eye unless exposed to a black light. Long/short wave fluorescent ink is a colorless or transparent ink that fluoresces under an ultraviolet light source. The ink fluoresces two different colors depending on the wavelength of UV light – red at a short wavelength, and blue at a long wavelength. Also known as a fluorescing watermark.

Strengths

- Fluorescent inks provide moderate protection against copying and counterfeiting.

Liabilities

- Authentication requires the use of a black light.

Holograms

Holograms give the illusion of a solid object that changes appearance and sometimes seems to move when viewed from slightly different angles and sources of light.

Strengths

- When added to check stock, holograms are attractive and easy to authenticate.

- Holograms are very difficult for fraudsters to replicate.

Liabilities

- Made from films and metallic foils, holograms must be attached like a foil stamp. This makes them vulnerable to removal by a fraudster.

- Holograms tend to be more expensive than other print-based check fraud security features.

Laid Lines

Lines are printed onto the surface of the document in a specially formulated gray ink that makes alteration difficult for the fraudster.

Strengths

- Laid lines are difficult to accurately replicate with desktop inkjet printers and make cut-and-paste alterations easier to detect.

Liabilities

- Laid lines can impact image capture data size.

Microdots

The document is imprinted with a series of very small circles with differing dot sizes within them. This feature is used as both a quality control device and a semi-covert security image as microdots are not reproducible on most scanners and copiers. Also known as DQIs or dot quality indicators.

Strengths

- Microdots provide very good protection against color and black & white photocopying.

Liabilities

- A loupe or other form of optical magnification is required for authentication.

Microprinting

Microprinting is a reduced line of type that appears as a solid or dashed line – until viewed under magnification. Characters, words or phrases are then distinguishable in the image.

Strengths

Most copiers and scanners, unless capable of very high dots-per-inch quality, will “see” the microprinting as a solid line.

Liabilities

- A loupe or other form of optical magnification is required for authentication.

Optically Variable Ink

Ink can be used that changes color when viewed at different angles. The most current redesigns of U.S. currency utilize OVI.

Strengths

- OVI provides excellent protection against copying and counterfeiting. It can be readily authenticated in the field by those trained in its detection.

Payee Protection Font

A special alphanumeric font can be used that makes modifying the payee and legal amounts fields of the check more difficult.

Strengths

- The unique appearance of the font requires forgers to match the typeface when attempting alterations of the payee and legal amount fields.

Liabilities

- The font itself is relatively easy to replicate and manipulate with conventional graphic editing tools and offers limited protection against copying.

Prismatic Print

Two or more ink colors are blended together in the printing of the check stock.

Strengths

- Prismatic print is difficult to copy and extremely difficult to counterfeit on color printers.

- The forger must replicate two colors and maintain print registration in the process.

Liabilities

- Prismatic printing requires two colors, adding somewhat to the cost of producing check stock.

Secure Number Font

A proprietary non-traditional font is used that varies the size and shape of the characters.

Strengths

- The unique design of the font – and the fact that its distribution is controlled to those in the financial industry – makes counterfeiting difficult.

Liabilities

- Some users find the unusual appearance of the font unappealing.

Tamper-Evident Coatings

A protective chemical coating is applied to the document that activates the word “VOID” in three languages when exposed to bleach, solvents or hypochlorites commonly used for washing check documents.

Strengths

- Provides moderate protection against chemical alteration of the image, although fine use of chemicals can limit visibility of the voids.

- Can be used to field-authenticate a document with the use of a chemical pen or bleach.

Liabilities

- Certain laser-compatible coatings are currently limited to bleach activation, although some other mill-grade papers do support full chemical sensitivity on laser stocks.

Thermochromic Ink

Thermochromic ink changes color or disappears when warmed and returns to its normal color upon cooling. Also known as mood ink.

Strengths

- This feature provides a good level of protection against copying and counterfeiting.

- It can easily be authenticated in the field without any special equipment.

Liabilities

- Thermochromic ink is susceptible to strong solvents and abrasion in check-washing fraud schemes.

- It has limited lightfastness if exposed to direct sunlight or fluorescent office lighting for an extended period.

Toner Lock

A clear coating is printed over sensitive areas of the check to protect against alternation of those areas later on. The coating makes removal of laser printer toner extremely difficult compared to untreated paper.

Strengths

- Some printer and paper combinations offer poor toner bonding – which makes the check easier to alter. The coating enhances the bonding of toner to paper, complicating alteration for the fraudster.

Liabilities

- Most toners adhere very well to bond stocks, resulting in minimal improvement.

Void Pantographs

Void pantographs are warning messages hidden in printed pantograph backgrounds which are difficult to reproduce and provide effective protection against color copier fraud. A “void” warning message appears when the document is photocopied.

Strengths

- Void pantographs provide protection against color copying. The word “VOID” appears on the photocopied image, defacing what would otherwise appear to be a good copy of the original check.

Liabilities

- They provide less protection against scanning and printing.

Warning Bands

Text on the face of the document informs the person accepting the check which security features should be present.

Strengths

- A warning band encourages verification of the document and discourages criminal activity.

Liabilities

- Unfortunately, warning bands are often ignored when documents are accepted.

Taylor: A Leader Document Security

.jpg?width=1455&height=626&name=Blog%20Body%20Image%20%E2%80%93%20Check%20Security%20+%20Fraud%20Prevention%20(3).jpg)

Taylor has been a recognized leader in document security technology for decades and holds dozens of patents to prove it. We don’t just license document security features – we invent them. In fact, Taylor is on the X9B Financial Services Operations Subcommittee and actively participates in the development of the check security standards used by the financial services industry.

Many of the check fraud security features noted in this blog are available from Taylor. To learn about Taylor’s expertise with fraud prevention and document security technology, contact one of our document management specialists.