As ACH, credit card and digital wallet payments grow in popularity, many small- and medium-sized businesses (SMBs) are left to wonder:

Do businesses still send checks?

Our recent blog on the topic How to Choose Business Checks revealed that the answer is a resounding “yes.” Not only did the percentage of U.S. businesses using checks increase in 2024, business checks remain the third most common payment method accepted by small businesses, following only credit/debit cards and cash. That’s because secure business checks offer a tangible, traceable method of transaction that is still preferred by many business owners.

However, ever-present concerns about check fraud schemes lead to some important questions:

- How do businesses send and receive business checks?

- What are the best practices of check writing for a small business?

- What are some check fraud best practices that businesses can remember to minimize risk when sending and receiving business checks?

This blog will take a high-level look at business check processing and how secure business checks play an important role in safeguarding business payments.

1. How do businesses send and receive business checks?

The most common methods of sending and receiving business checks have changed little over the years. Small- and medium-sized businesses typically send corporate checks through one of the following.

- Mail delivery: Mail delivery remains the most traditional way to send business checks. The checks are simply printed and mailed to vendors, contractors or service providers as needed. This approach is still widely used, especially in industries like construction, legal services and healthcare.

- Courier services: For high-value or time-sensitive payments, businesses may send checks via courier services to ensure secure and timely delivery.

- In-person hand-offs: Local businesses often hand-deliver business checks to nearby vendors or employees, especially when trust and immediacy are important.

- Bank-issued checks: Some businesses use their bank’s online platform to issue checks directly to recipients. These are printed and mailed by the bank, saving time and reducing manual errors.

In return, businesses continue to receive checks in several ways and for specific reasons.

- Customer payments: Many SMBs still accept business checks from customers, especially for large purchases or services.

- Vendor refunds or rebates: Businesses may receive checks from suppliers for returned goods or promotional rebates.

- Government payments: Grants, tax refunds and other government disbursements are often issued via check.

With the proliferation of digital payment options, why is this still a standard operation procedure for so many businesses? Why are SMBs still engaged in sending and receiving business checks? Despite the availability of electronic payment systems, secure business checks remain popular for several reasons:

- Record keeping: Business checks provide a paper trail that’s easy to archive and reference.

- Security: Unlike digital payments, business checks can be physically tracked and canceled if lost.

- Control: Writing a business check allows business owners to control the timing and amount of payment precisely.

- Vendor preferences: Some vendors, especially smaller or local ones, prefer checks over electronic payments due to lower fees and simplicity.

2. What are the best practices of check writing?

Writing checks may seem straightforward but it’s crucial that businesses follow certain steps to ensure accuracy, professionalism and security. Here are some check writing best practices to remember.

Use pre-printed business checks

Always use high-security business checks — never personal checks — that include your business name, address and bank information. This adds credibility and helps recipients verify the source of the payment.

Keep a consistent check register

To aid reconciliation later and prevent duplicate payments, immediately record the following information in a check register after writing any corporate check:

- Check number

- Date issued

- Payee name

- Amount

- Purpose of payment

Write legibly and avoid blank spaces

Don’t take shortcuts that could open the door to check fraud schemes. Ensure all fields on the business check are filled out properly:

- Use permanent ink

- Avoid leaving blank spaces that could be altered

- Write the amount in both numeric and written form

Include a memo

A brief note can optimize check processing for payor and payee alike. Use the check’s memo line to specify the purpose of the payment (e.g., “Invoice #1234” or “July Rent”) to help both parties track the transaction.

Sign consistently

Only authorized personnel should sign business checks. A signature stamp or digital signature may be used for consistency and efficiency but only if it is securely stored and its use is tightly controlled.

Reconcile bank statements monthly

Regular reconciliation of the account that corporate checks are drawn from helps to identify errors, uncover unauthorized transactions and maintain accurate financial records.

Use accounting software integration

Many SMBs use accounting software like QuickBooks to print business checks and automatically record transactions. This reduces manual entry errors and improves efficiency.

3. What are check fraud best practices?

Check fraud remains a significant threat to businesses but there are several things businesses can do to stop fraud before it happens. Here are some key strategies to protect your business.

Use high-security business checks

Make it as hard as possible for fraudsters to alter or replicate checks. Always purchase business checks with advanced security features built in such as:

- Watermarks

- Microprinting

- Holograms

- Heat-sensitive ink

- Tamper-evident backgrounds

Implement positive pay

Positive Pay is a fraud prevention service offered by banks. Businesses submit a list of issued checks to the bank, which then verifies each check presented for payment. If a check doesn’t match the list, it’s flagged for review.

Limit check access

Restrict access to blank checks and check-writing privileges to trusted employees. Store business security checks in a locked drawer or cabinet and monitor usage.

Use dual authorization

Require two signatures for business checks above a certain amount. This adds an extra layer of oversight and reduces the risk of internal fraud.

Monitor bank accounts daily

Set up alerts for large withdrawals or unusual activity. Daily monitoring helps detect fraud early and allows for quick action.

Educate employees

Train staff on how to spot suspicious checks and report concerns. Encourage a culture of vigilance and accountability.

Verify vendors and payees

Before sending a business check, confirm the legitimacy of the vendor or payee. Fraudsters often impersonate legitimate businesses to receive unauthorized payments.

Avoid post-dated checks

Post-dated checks can be deposited early, leading to overdrafts or disputes. Always issue corporate checks with the current date unless absolutely necessary.

Shred voided or unused checks

Never discard business checks in the trash. Use a cross-cut shredder to destroy voided or unused checks to prevent dumpster-diving fraud.

Review bank statements for alterations

Look for signs of check washing, where fraudsters remove ink from a legitimate check and rewrite it. If you notice discrepancies, contact your bank immediately.

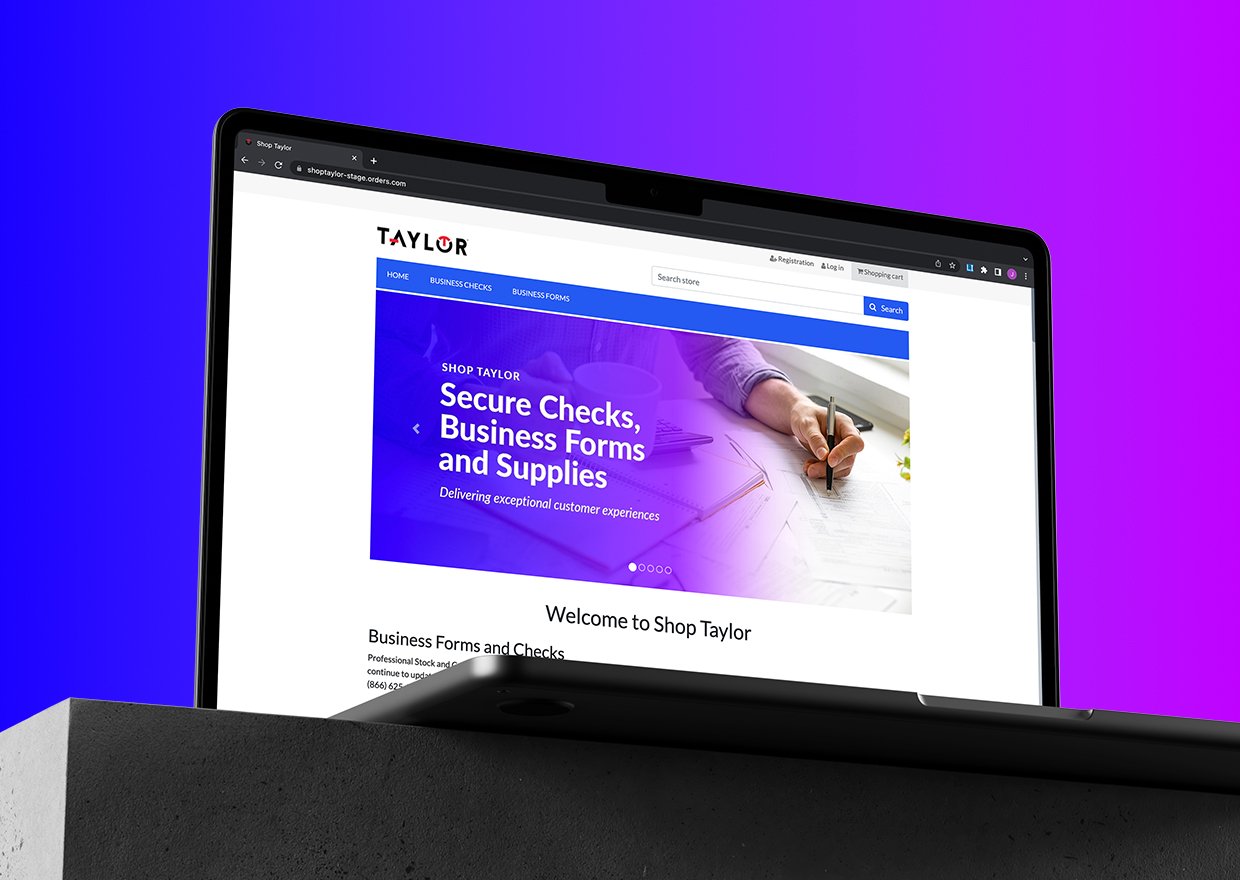

Shop.Taylor: High-security business checks for SMBs

One of the largest providers of secure business checks in North America, Taylor Corporation has been a leader in secure printed business documents for decades. Taylor actually developed many of the advanced business check security features used by financial institutions nationwide. Now, those same high-security business checks are available to small- and medium-sized businesses through Shop.Taylor.com.

The direct e-commerce ordering service of Taylor, Shop.Taylor.com gives you access to a wide assortment of business laser checks and pressure seal checks — all with high availability and fast turnround times. Shop.Taylor.com is also a convenient online resource for business forms including:

- Invoices and statements

- Medical forms

- Pressure-seal forms

- Purchase orders

- Shipping and receiving forms

- Tax forms

Still sending and receiving business checks? Work with the company that invented many of the anti-fraud features that define modern secure business checks. Go to Shop.Taylor.com and browse our entire selection of business laser checks and pressure seal checks.