Our recent blog on check processing best practices touched on many things that should be considered by small and medium-sized businesses (SMBs) when using checks. However, it stopped short of exploring more technical issues like MICR technology or specific business check processing compliance requirements.

This next blog in our series on business checks will serve as a business check processing compliance checklist of sorts, addressing eight topics that — when considered holistically — serve to optimize check processing for businesses.

- What is MICR?

- What are the 7 parts of a check that make it valid?

- What should a business check have that sets it apart from a personal check?

- What kind of checks should you have for a business?

- What are the steps in check processing?

- What is business check processing compliance?

- How do you ensure business check processing compliance as a business owner?

- What are check acceptance guidelines and how do they relate to business check processing?

What is MICR?

MICR stands for “magnetic ink character recognition,” a specialized technology used to print and read the line of characters at the bottom of checks. This line includes the routing number, account number and check number, all printed with MICR technology — a unique font that uses magnetic ink or toner.

MICR enables high-speed, automated check processing by financial institutions. When scanned, the magnetic properties of the ink allow machines to read the characters even if the check is smudged or marked. MICR technology is governed by ANSI X9 standards which specify font, placement and ink quality to ensure consistency across all checks processed in the U.S.

What are the 7 parts of a check that make it valid?

To be considered valid and processable, a check must include the following seven components:

- Date: Indicates when the check was written. Postdated checks may not be honored until the specified date.

- Payee line: The name of the individual or business receiving the funds.

- Amount box: The numerical value of the payment.

- Amount line: The written amount, which serves as a backup in case the numerical value is unclear.

- Signature line: The authorized signature of the account holder.

- Memo line: Optional, but useful for noting the purpose of the payment.

- MICR line: Contains the routing number, account number and check number in magnetic ink for processing.

Each of these seven elements plays a role in ensuring the check is legally binding, traceable and processable by banks.

What should a business check have?

Business checks differ from personal checks in several ways. These differences are designed to support higher volumes, enhance check fraud protection and enable more complex workflows.

- Larger format: Business checks often come in voucher or stub formats, providing space for accounting details and recordkeeping.

- Security features: High-security business checks often include watermarks, microprinting, heat-sensitive ink and other security features to help prevent fraud and tampering.

- Preprinted company information: Business name, address and logo are typically printed on corporate checks for branding and verification.

- Check numbering and control: Sequential numbering and compatibility with accounting software help track payments and prevent duplication.

- Multiple signature lines: Some business checks include space for dual authorization, especially for high-value transactions.

- Compatibility with printers and software: Business checks are typically designed to work with QuickBooks, Sage and other accounting platforms.

These unique features help to secure business checks and streamline financial operations in ways that an ordinary personal check could not.

What kind of checks should you have for a business?

Choosing the right type of business check depends on your business size, payment volume and accounting needs. Here are the most common types:

Manual Checks

Pros:

- Simple and inexpensive

- No special equipment needed

Cons:

- Time-consuming

- Prone to errors

- Limited security features

Business Laser Checks

Pros:

- Compatible with accounting software

- Faster and more accurate

- Can include advanced security features

Cons:

- Requires a MICR-compatible printer

- Higher upfront cost

Voucher Checks

Pros:

- Includes detachable stubs for recordkeeping

- Ideal for payroll and vendor payments

Cons:

- Larger format may not fit all printers

- Slightly more expensive

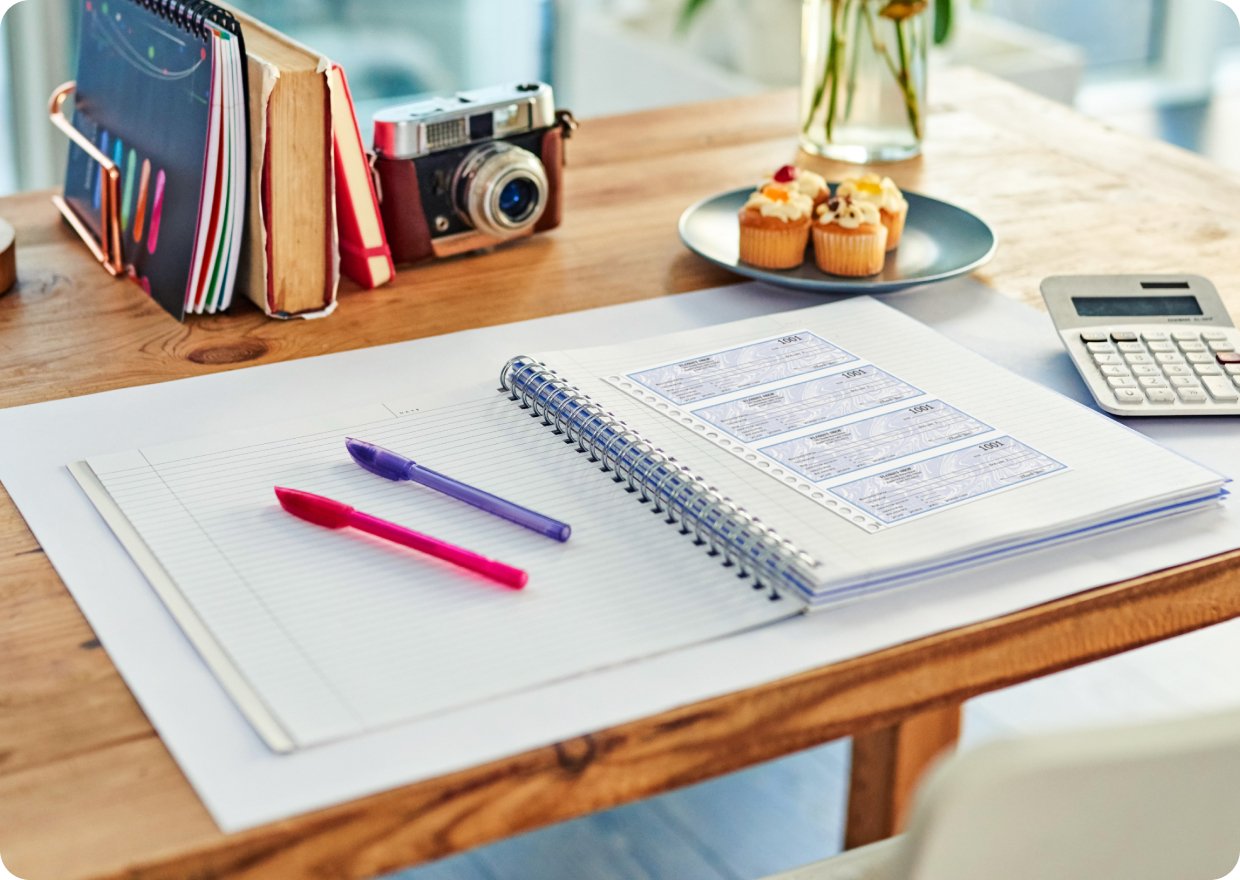

Three-to-a-Page Checks

Pros:

- Efficient for high-volume payments

- Fits standard check binders

Cons:

- Less space for notes or stubs

- May require separate documentation

Blank Check Stock

Pros:

- Flexible for use with multiple accounts

- Cost-effective for bulk printing

Cons:

- Requires secure check printing equipment

- Higher risk if not properly managed

Small businesses with limited transactions may start with manual or three-to-a-page checks while fast-growing companies often benefit from business laser checks or voucher checks integrated with accounting systems. You may decide to purchase business checks in different formats as your business needs change.

What are the steps in check processing?

Business check processing involves several stages, each designed to verify authenticity and ensure accurate settlement.

- Issuance: The business writes and signs the check, recording it in their accounting system.

- Deposit: The payee deposits the check at their bank or via mobile deposit.

- Encoding: The bank scans the MICR line and encodes the check for processing.

- Clearing: The check is routed through the Federal Reserve or a clearinghouse to the issuing bank.

- Verification: The issuing bank verifies funds, signature and account status.

- Settlement: Funds are transferred from the issuer’s account to the payee’s account.

- Archiving: Both banks retain digital or physical copies for processing compliance and audit purposes.

This sequence of events typically takes one to three business days, though delays can occur due to errors or insufficient funds.

What is business check processing compliance?

Business check processing compliance requirements focus on strict adherence to the federal, state and banking regulations that govern the issuance and handling of checks. Key areas include:

- MICR standards: Checks must meet ANSI X9 specifications for font, ink and layout.

- Security features: Businesses must often use checks with check fraud prevention features to protect customer and vendor data.

- Recordkeeping: IRS and state tax authorities require accurate documentation of payments.

- Banking agreements: Businesses must follow terms set by their financial institutions regarding check formats, limits and processing timelines.

- Privacy laws: Checks must not expose sensitive information such as Social Security numbers or medical data.

Noncompliance can result in rejected checks, fines or legal liability. For example, checks that fail MICR standards may be returned by banks, incurring fees and disrupting payments.

How do you ensure business check processing compliance?

To stay compliant and protect your business, consider the following best practices:

- Use MICR-compatible printers and ink: Ensure your business checks meet ANSI standards for magnetic readability.

- Purchase business checks from reputable vendors: Choose suppliers who guarantee compliance with banking and security standards.

- Implement internal controls: Require dual signatures for large payments and reconcile check logs regularly.

- Train staff: Educate employees on proper check handling, fraud prevention and recordkeeping.

- Secure your check stock: Always store blank business checks in locked cabinets and restrict access to authorized personnel.

- Audit regularly: Conduct periodic reviews of check issuance, bank statements and vendor payments.

- Stay updated: Monitor changes in banking regulations, privacy laws and accounting standards.

By following these steps, business owners can reduce risk, maintain trust and ensure smooth financial operations.

What are check acceptance guidelines and how do they relate to business check processing?

Check acceptance policies are internal guidelines that businesses establish to determine how, when and from whom they will accept checks. These policies support check fraud prevention and ensure consistency across transactions. Key components typically include:

- The types of checks accepted such as personal, business, cashier’s, certified or government checks. Many businesses exclude third-party or out-of-state checks from their check acceptance policies.

- Required check details such as preprinted name, address, bank routing number and account number. Some check acceptance guidelines require checks to be printed by a financial institution.

- Identification requirements such as a valid photo ID by the individual presenting the check.

- Authorization procedures that may involve manager approval or verification through a check guarantee service.

- Dollar limits that establish the minimum and maximum amounts allowed per check.

- Returned check handling procedures including fees, collection methods and customer notification protocols.

These check acceptance guidelines, in turn, are directly tied to business check processing compliance requirements in several ways:

- Check fraud prevention: Policies help detect and deter forged, altered or counterfeit checks. Using tools like positive pay or electronic check verification supports compliance with anti-fraud standards.

- Banking regulations: Businesses must follow rules set by their financial institutions and the Uniform Commercial Code (UCC) regarding negotiable instruments.

- Recordkeeping requirements: Accurate documentation of check transactions supports audit readiness and financial transparency.

- Privacy and data protection: Collecting customer information (e.g., ID numbers) must comply with privacy laws like GLBA or state-specific regulations.

- Electronic check processing compliance: If using digital systems (e.g., remote deposit capture or ACH conversion), businesses must follow NACHA rules and ensure secure handling of check images and data.

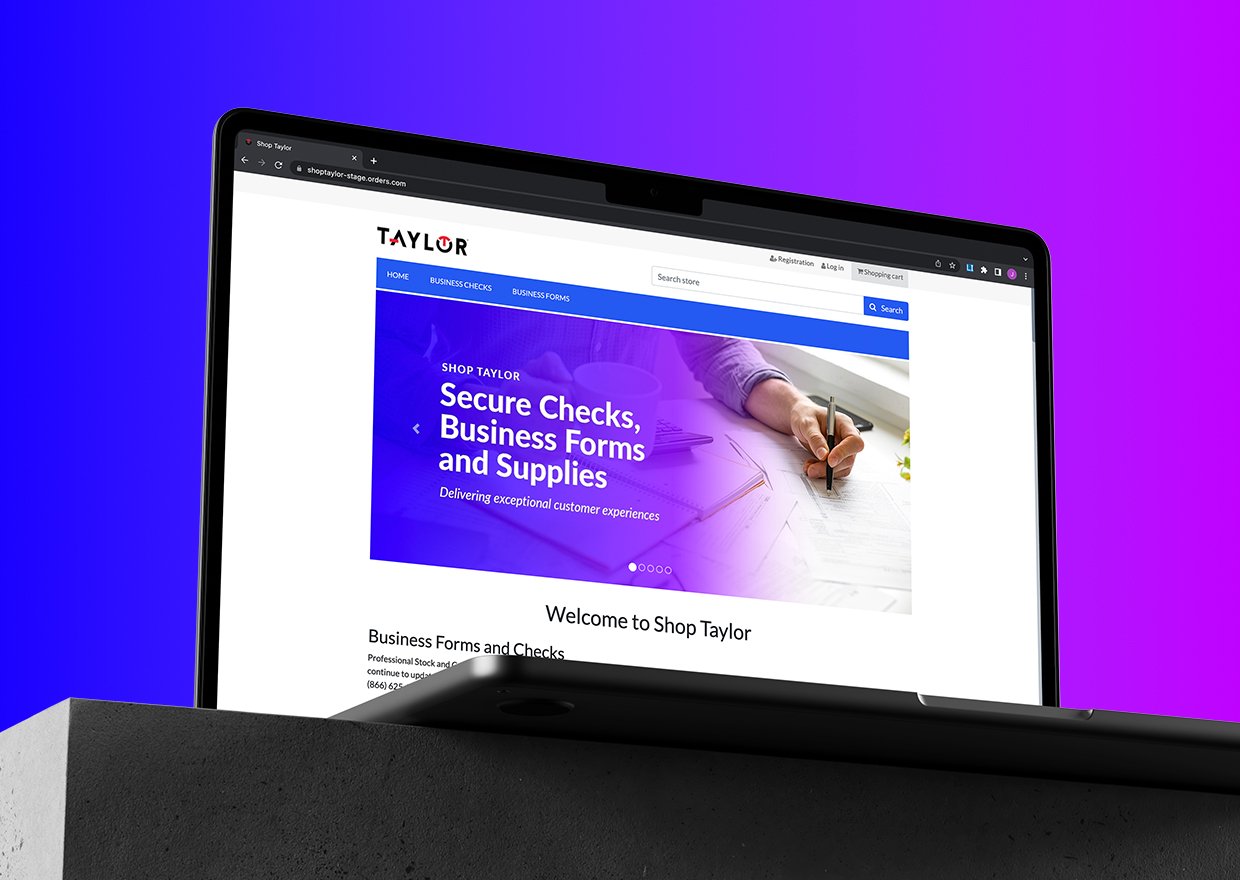

Shop.Taylor: High-Security Business Checks for Optimized Check Processing

Ordering high-security business checks through Shop.Taylor.com is an easy, convenient way for small businesses to embrace the check processing best practices described above. We offer business laser checks and pressure-seal checks with built-in check fraud prevention features including:

- Artificial watermarks

- CopyBan Capture void pantographs

- Defaced vouchers

- Full chemical void sensitivity

- Laid lines

- LaserLock

- Latent images

- Microprinting

- Thermochromic ink

- Warning bands, and more

Looking for a better way to purchase business checks and optimize check processing for your business? Visit Shop.Taylor.com and explore the various styles of high-security business checks available. You can also order your business forms at Shop.Taylor.com — everything from invoices, purchase orders and shipping forms to tax forms, medical forms and much more. Shop.Taylor.com is a one-stop shop for all of your secure business document needs.